Renters Insurance in and around Milford

Looking for renters insurance in Milford?

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

- Harrington

- Lincoln

- Frederica

- Greenwood

- Ellendale

- Felton

- Dover

- Camden

- Lewes

- Milton

- Bridgeville

- Georgetown

Insure What You Own While You Lease A Home

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented space or property, renters insurance can be the most sensible step to protect your valuables, including your lamps, bed, golf clubs, exercise equipment, and more.

Looking for renters insurance in Milford?

Coverage for what's yours, in your rented home

Safeguard Your Personal Assets

When renting makes the most sense for you, State Farm can help cover what you do own. State Farm agent Shawn Collins can help you generate a plan for when the unanticipated, like an accident or a water leak, affects your personal belongings.

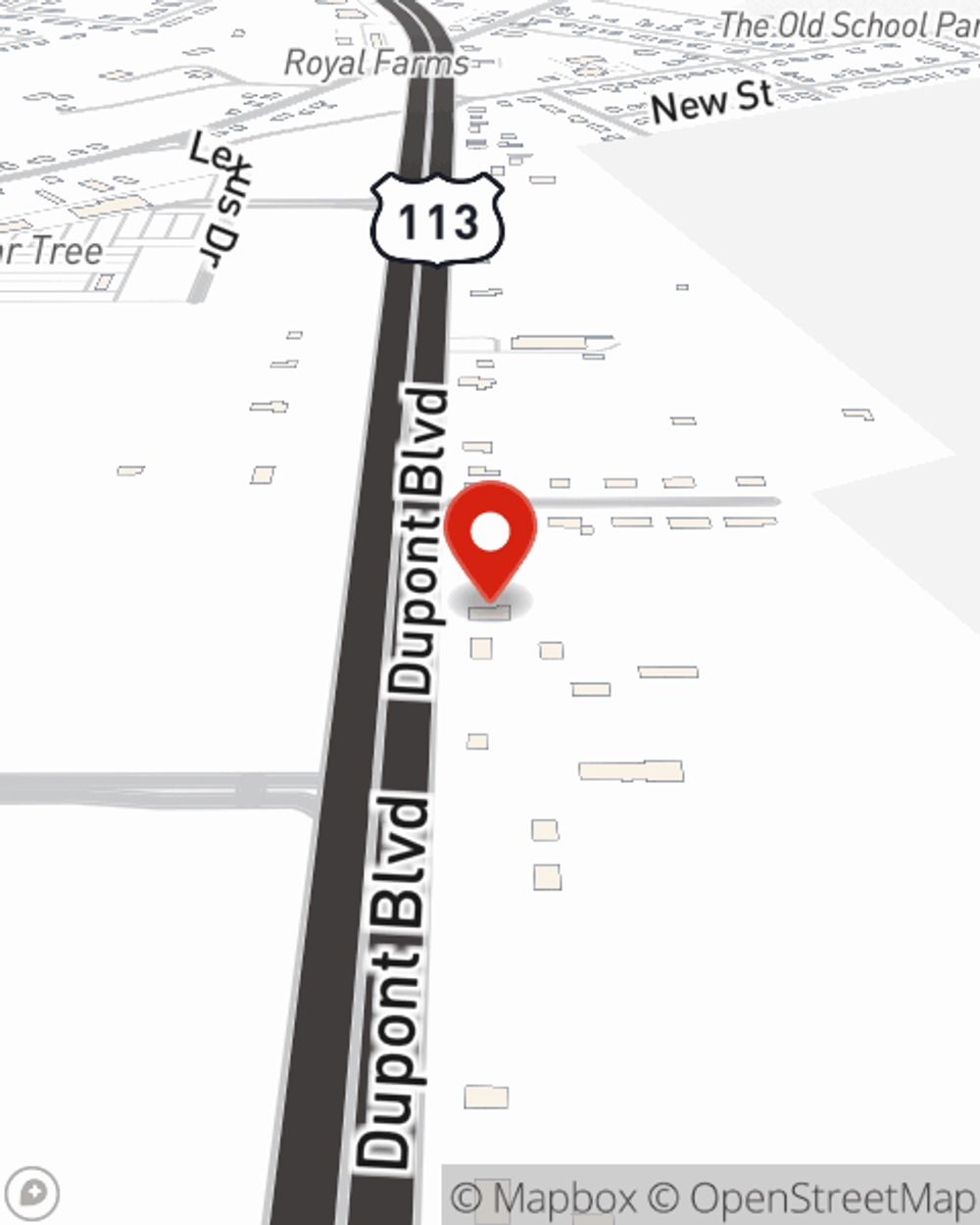

There's no better time than the present! Visit Shawn Collins's office today to learn more about State Farm's coverage and savings options.

Have More Questions About Renters Insurance?

Call Shawn at (302) 422-2235 or visit our FAQ page.

Simple Insights®

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

Shawn Collins

State Farm® Insurance AgentSimple Insights®

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.